child tax credit payment schedule for october 2021

The payments will be paid via direct deposit or check. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

2021 Child Tax Credit Advanced Payment Option Tas

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income.

. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Parents income matters too. 30 thanks to the 1992 Taxpayers Bill of Rights TABOR.

So each month through December parents of a younger child are receiving 300 and. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

The payments will be paid via direct deposit or check. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The schedule of payments moving forward is as follows.

October 20 2022. Six payments of the Child Tax Credit were and are due this year. The child tax rebate which was recently authorized by the connecticut general assembly and signed into law by governor ned lamont is intended to help connecticut families.

The Child Tax Credit payments are being sent out to eligible families who have filed either a 2019 or 2020 tax. Child tax credit payments will revert to 2000 this year for eligible taxpayers credit. Frequently asked questions about the tax year 2021filing season 2022 child tax credit.

Thats an increase from the regular child tax. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. We dont make judgments or prescribe specific policies.

Each payment will be up to 300 for each qualifying child. File a federal return to claim your child tax credit. So parents of a child under six receive 300 per month and parents of a child six or.

The advance CTC payments are worth up to 300 per month for each qualifying child under the age of six and up to 250 for each child between the ages of 6 and 17. Determine if you are eligible and how to get paid. State residents who have filed their 2021 return by June 30 will get a physical check for 750 by Sept.

The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36 million families believed to be eligible to receive them. December 13 2022 Havent received your payment. Each payment will be up to 300 for each qualifying child under the age of 6 and up to 250 for each qualifying child from.

Simple or complex always free. A childs age determines the amount. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

Maine taxpayers who have filed their 2021 state tax returns and have an adjusted gross income of less than 100000 are eligible for an 850 direct relief payment. What is the schedule for 2021. Child tax credit payment schedule 2022 ojogos from wwwojogosinfo.

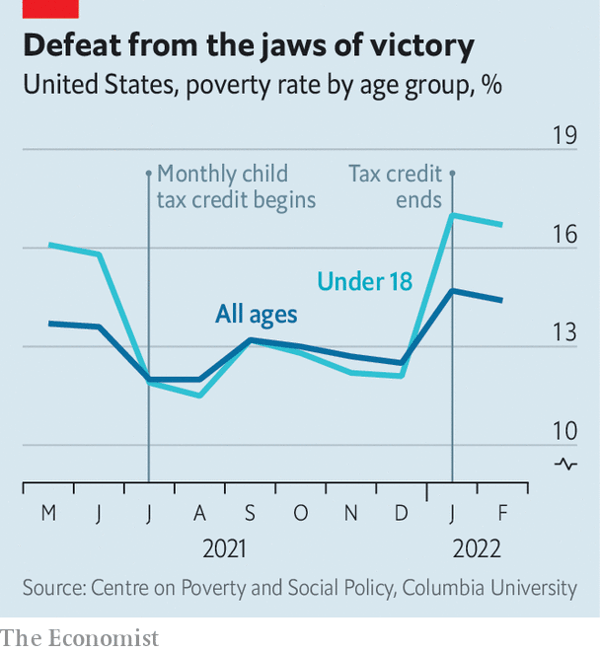

Goods and services tax. The first two child tax credit payments lifted 35 million kids out of poverty according to a recent estimate by Columbia Universitys Center on Poverty and Social Policy. See what makes us different.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. IR-2021-201 October 15 2021. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6.

Wait 5 working days from the payment date to contact us. Recipients can claim up to 1800 per child under six this year split into the six. Under the build back better act you generally wont receive monthly child.

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here S How Cnet

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

Child Tax Credit Payment Delays Frustrating Families In Need The Washington Post

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Will There Be Another Check In April 2022 Marca

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Childctc The Child Tax Credit The White House

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet